Publications

2022-2023 State Budget

2022-23 Biennium

- Final State Budget for the 2022-23 Biennium Tops $251.5 billion (February 2022)

- State ARPA Appropriations (October 2021)

- Infographic: The 2022-23 state budget by the numbers (October 2021)

- SB 1 Conferees Reach Consensus, Adopt Budget Decisions (May 2021)

- Senate Bill 1 Conferees Appointed (April 2021)

- Senate Finance Committee Adopts Committee Substitute for Senate Bill 1 (April 2021)

- House Appropriations Committee Completes Mark-Up of House Bill 1 (April 2021)

- Senate Finance Committee Completes Budget Markup (March 26)

- Budget-Writing Committees Temporarily Pause, but Prepare for What's Ahead (March 12)

- Budget-Writing Committees Continue Their Work (February 2021)

- State Budget Outlook Improves (February 2021)

- Governor Abbott's Budget for the 2022-23 Biennium Released (February 2021)

- Budget recommendations released by the House and Senate (January 2021)

Budget Surplus/(Deficit)

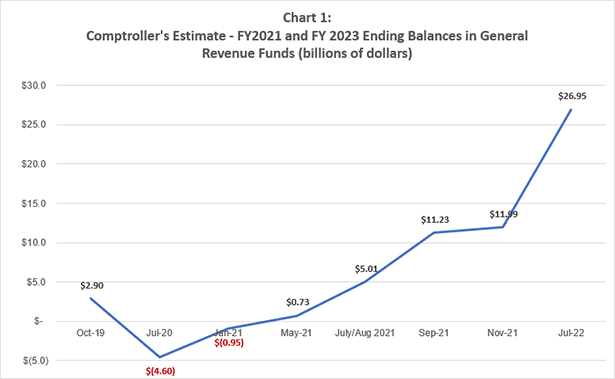

The Texas economy was hit hard by the double whammy of the coronavirus pandemic and low oil prices, driving down tax revenues. In response, Comptroller Glenn Hegar, the state equivalent of a county auditor and a county treasurer combined, cut the biennial revenue estimate, projecting a $4.6 billion budget deficit for the then current (2020-21) budget in July 2020. There has been a remarkable turnabout since then, culminating in a projected $27 billion surplus available to fund the 2024-25 budget. Chart 1 shows the Comptroller's estimate of ending balances in the state's general revenue funds for the two-year budget that ended Aug. 31, 2021, and the current budget that ends Aug. 31, 2023, which most recently is projected to be a $27 billion surplus.

2020-21 state budget surplus/(deficit)

- $2.9 billion surplus – Comptroller's certification revenue estimate (CRE) for the 2020-21 biennium (Oct. 2019)

- $4.6 billion deficit – Comptroller's revised CRE for the 2020-21 biennium (July 2020)

- $946 million deficit – Comptroller's Biennial Revenue Estimate (BRE) for the 2022-23 biennium (Jan. 2021)

- $725 million surplus – Update Comptroller's BRE for the 2022-23 biennium (May 2021)

- $5.01 billion surplus – Comptroller's Revenue Estimate for the 87th Legislature, First- and Second-called sessions (July/Aug. 2021)

- $11.23 billion surplus – Comptroller's Revenue Estimate for the 87th Legislature, Third-called session (Sept. 2021) and Comptroller's CRE for 2022-23 Biennium (Nov. 2021)

2022-23 state budget surplus/(deficit)

- $11.992 billion surplus - Comptroller's CRE for 2022-23 Biennium (Nov. 2021)

- $26.95 billion surplus - Comptroller's revised CRE for 2022-23 Biennium (July 2022)

Factors contributing to the turnabout:

- Three major federal fiscal relief packages.

- Legislative action – the 5% budget cuts and substituting federal relief funds for General Revenue appropriations.

- Rebounding state revenue collections – the largest one-year increase in total tax collections, as compared with the prior fiscal year, in Texas history. Hegar said elevated prices due to inflation increased state tax receipts. For more on estimated state tax collections, see Chart 2.

| CHART 2: Estimated Growth in Major State Taxes | ||

| Major State Tax |

Estimated Biennial Growth

(Nov. 2021)

|

Revised Estimate

(July 2022)

|

| Sales | 11.8% | 23.6% |

| Motor Vehicle Sales and Rental Taxes |

8.8% | 14.4% |

| Oil Production | 43.1% | 91.8% |

| Natural Gas Production | 89.2% | 266.8% |

| Total Tax Collections | 15.2% | 32.6% |

| Data source: Comptroller of Public Accounts | ||

This surplus is in addition to the $13.7 billion fiscal year 2023 ending balance Hegar projects for the Rainy Day Fund. Both ending balances could be reduced by supplemental appropriations bills for the 2022-23 two-year budget.

For more information contact:

Fiscal Policy Analyst

Zelma Smith

(800) 456-5974